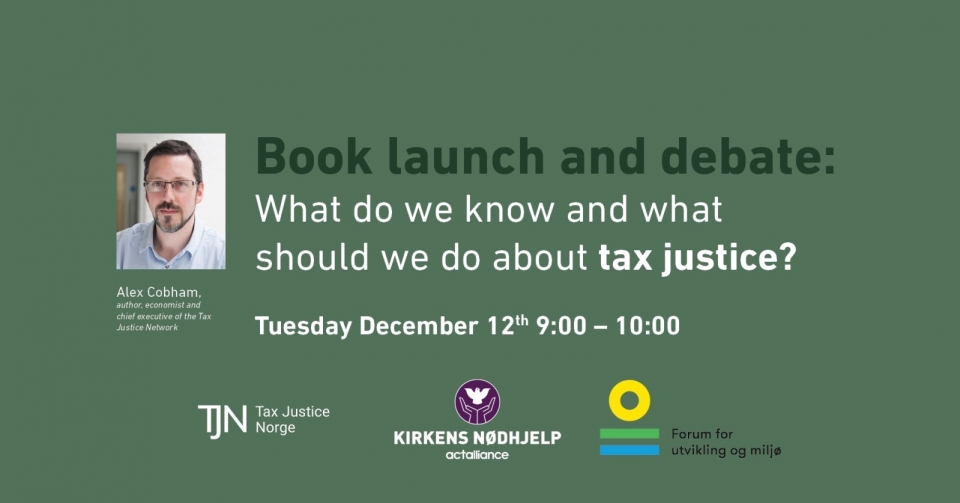

Book launch and debate: What do we know and what should we do about tax justice?

ForUM, Kirkens Nødhjelp, Tax Justice Norge

Kulturhuset

Youngs gate 6

Oslo

Welcome to this open breakfast meeting! This event is divided in two - first a book launch with Alex Cobham (in English), then a debate with politicians (in Norwegian).

You will hear from:

- Alex Cobham (Author and Chief Executive, Tax Justice Network)

- Ole Jakob Sending (Research Director, NUPI)

- Ingrid Fiskaa (MP, Socialist Left Party)

- Nils-Ole Foshaug (MP, Labour Party)

- Bjørg Sandkjær (State Secretary Ministry of Foreign Affairs)

- Heidi Nordby Lunde (MP, Conservative Party)

- Anne Sofie Lid Bergvall (Moderator)

REGISTRATION

Please register so we know how much breakfast we should order:

https://forms.office.com/e/stbDcUfSUD

STREAMING

If you can’t show up physically, you can follow the book launch and debate here on the event site.

PRACTICAL INFORMATION

08:30: Serving of coffee and breakfast

09:00: The program starts (duration: 1 hour)

The book launch and interview with Alex Cobham (09:00-09:30) will be in English.

The debate with Norwegian politicians (09:30-10:00) will be in Norwegian.

PROGRAM

ENGLISH:

09:00: Book launch: What do we know and what should we do about tax justice?

Author Alex Cobham (Tax Justice Network) is interviewed by Ole Jacob Sending (NUPI).

Alex Cobham is an economist and chief executive of the Tax Justice Network. “What Do We Know and What Should We Do About Tax Justice?” is Cobham’s third book, and it lays out what we know about the scale, history and impacts of tax abuse.

Read more about the book here:

https://us.sagepub.com/.../what-do-we-know-and.../book286416

Ole Jacob Sending is the Director of Research at the Norwegian Institute of International Affairs. He has led an expert group, appointed by the Norwegian Government, to make recommendations on financing for the Sustainable Development Goals. The expert group delivered its report May 15th and recommended that Norway should double its support to UN Agenda 2030.

NORWEGIAN:

09:30: Debatt med norske politikere: FN, skatteregler og lederskap fra Afrika.

22 november vedtok FN en resolusjon som kickstarter en prosess for å få på plass en skattekonvensjon i FN. Målet er at konvensjonen skal bli starten på slutten for skatteparadiser og deres skadelige konsekvenser.

Skatteunndragelse og uønsket skattetilpasning er et alvorlig problem verden over. I sommer kom en rapport fra Tax Justice Network som sa at hvis vi ikke endrer kurs, vil verden tape nesten 5000 milliarder dollar til skatteparadiser i løpet av de neste 10 årene - det samme som tre norske oljefond.

Samtidig som pengene renner ut av statskassene og inn i skatteparadiser, sliter mange land med å finansiere grunnleggende tjenester som helse og utdanning, i tillegg til å forhindre katastrofale klimaendringer.

Hva kan verdens stater gjøre for å få bukt med skattetriksing? Vil en skattekonvensjon i FN bidra til å bekjempe problemet? Hvilken rolle kan Norge spille?